When is it viable for consumer brands to sell direct-to-consumer?

One of the most significant changes in the consumer goods industry in the last few years has been the emergence of transactional direct-to-consumer (D2C) propositions. These new ventures stand in stark contrast to the traditional route to market for these firms (where brands have sold to wholesalers, distributors and retailers), and offer brands an opportunity to develop a direct relationship with the end consumer.

To this end, it is crucial for all consumer packaged goods (CPG) firms to understand why they should consider D2C, and how they can assess whether it can be a successful strategy for them.

Why consider D2C?

With the CPG landscape changing quicker than ever before, brands are facing multiple pressures:

1 Increasingly competitive landscapes fueled by a lower cost of entry for niche brands: A multitude of niche brands are emerging, particularly in categories where inspiration and emotion play a role in purchase decisions. With greater access and transparency than ever before, new brands with compelling USPs can easily win the hearts and loyalties of consumers. Indeed, according to research by Nielsen, while smaller brands made up just 19% of the US market in 2017, they contributed 53% of market growth.

2 Rise of automatic reordering driving a move to “default” brands for lower engagement purchases: New technologies such as automatic reordering (e.g. Amazon Dash) and voice search (e.g. Alexa, Echo, Google Home, Cortana) are starting to take hold, encouraging consumers to turn to “default” brands for their lower engagement and habitual purchases. This means that unless brands have a voice strategy and engage with these new touchpoints they increasingly run the risk of remaining “cut off” from consumers’ habits and homes.

3 Pressure on margins due to the rise of Amazon and an increasing retailer network: Amazon is becoming ever more powerful (research suggests that 50% of US consumers start product searches on Amazon) whilst the largest retailers are looking at strategic opportunities to increase their dominance through M&A (research by Accenture Strategy found that in the past two years alone, over a third of retailers globally have completed five or more acquisitions). Although the impact of the high profile consolidations has yet to be worked through, it is likely to result in a pressure on brands to squeeze margins or invest more with these players.

Given these trends, it is more important than ever for established brands to become and remain front-of-mind with consumers to drive continued sales. A key way to do this is to establish a direct dialogue with the end consumer and build direct consumer relationships. This blog explores how to assess whether this is a viable option for your brand.

What makes a transactional D2C proposition viable?

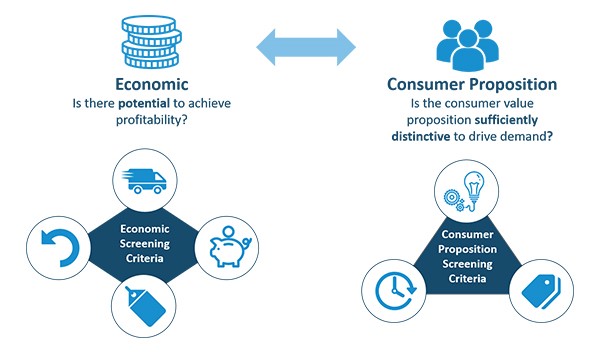

D2C offers advantages beyond additional sales, including marketing activation, brand awareness and access to end consumer data – all of which are key building blocks for building stronger brand loyalty. However, while it is relatively straightforward to launch a D2C operation, it is much more challenging to turn it into a scalable and profitable business. Before launching and scaling a D2C proposition, brands need to consider whether it meets two key criteria:

- Economic – is there a potential to achieve profitability at an item level?

- Consumer proposition criteria – can we be suitably differentiated and distinctive to drive demand?

i Per-item economic viability criteria

Ultimately, transactional direct-to-consumer propositions must be profitable. The economics to drive a profitable D2C proposition are much more complicated than the economics of selling via retail partners, and are often underestimated. Due to high fulfilment costs, premium rather than everyday products tend to make for more viable D2C propositions, although brands can reduce these high costs with optimised packaging, focussing on temperature, size or weight, and increase margins as a result. Brands such as Graze, Bloom & Wild and Splosh, for example, have developed products that can be delivered via Royal Mail through the postal service, at a cheaper cost that courier delivery.

Selling multiple products in multi-packs or bundles can also work, and this approach is particularly suitable in non-perishable categories with high purchase frequency, such as sports nutrition and personal care. Both Harry’s and Dollar Shave Club for example sell a starter “bundle” with the aim of ensuring the first customer order is profitable.

As well as reducing or covering these costs, brands can also pass them onto the consumer, fully or partially. This will only be possible, however, if the proposition is strong and the price is such that a delivery fee is acceptable. On top of this, order frequency must be sufficiently high not only to compensate for the investment in D2C capabilities, such as technology platforms and operational processes set-up proposition, but also to serve the end goal of consumer-brand relationship building.

ii Consumer proposition criteria

To purchase directly from a brand, consumers need to be offered something that is sufficiently distinctive versus what they are offered by purchasing through a retail partner channel. Are the product and proposition unique, convenient and price-competitive enough to constitute compelling options? Unless the answer is “yes” to at least one of these questions, the proposition will likely struggle to create enough demand to become viable.

Brands can choose to focus on only one of these three aspects as the pillar of their proposition. Leading on convenience is challenging given that consumers likely have near-immediate, cheap access to a grocery store or to Amazon’s next-day and same-day delivery options – for most brands, it would be very costly to match such a proposition. Alternatively, brands can propose a unique, exclusive product for which consumers would be willing to pay a premium and/or wait a little longer.

Naturally, consumer proposition decisions must be tied to consumer research at all stages of the “test & learn journey” – only by using a consumer-first approach can a brand ensure that their D2C proposition is positioned for success.

iii Long-term economic viability criteria

To complement these basic viability criteria, brands must also consider the economics of customer acquisition and D2C set-up. For a D2C opportunity to have merit, consumer lifetime value (CLV) must be greater than these initial costs. Subscription-based D2C models imply a relatively high purchase frequency, and therefore (theoretically) drive higher CLV, which can help offset high acquisition costs.

However, with some high profile subscription-based D2C brands struggling to retain consumers, convenience-focused propositions (replenishment) could be more viable as consumers are less likely to lose interest in the product, to try to drive established behaviours and reduce the likelihood of cancelling.

Other brands are looking to build a strong, loyal community of consumers and use this to drive increased sales. Some sports shoe brands, for example, promote local running and fitness events, driving brand affinity. They utilise their brand websites but also other channels such as Facebook messenger or Instagram to engage and promote their events and brand.

To summarise, CPG businesses and other brands are under immense pressure to act quickly if they wish to survive in an increasingly competitive and digital market. Developing a direct-to-consumer proposition has clear advantages, enabling the brands to hold all of the margin, to stay front-of-mind and to develop a direct relationship with the end consumer. However, it is not the silver bullet that many brands are hoping for, and it is critical to ensure that the proposition is compelling but also economically viable.