What is the true value of the retail store?

As consumers and retailers embrace the digital age, it is time to re-evaluate the true value of the store and the role it plays in supporting wider retail business performance.

Without this, retailers, brands and other operators of ‘brick and mortar’ networks risk pursuing channel-specific investment strategies that underplay the benefits of a true, cohesive omni-channel retail ecosystem and may lead to sub-optimal performance across the business.

The traditional retail store channel continues to suffer from negative press as the invidious pressures of channel shift, currency fluctuation, and macro-economic uncertainty combine to push a series of well-known high street brands towards oblivion. Whilst it’s certainly fair to say that the role of the store in the wider customer journey is changing, with the vast majority of retail sales still involving the store – either as the solus channel for the purchase pathway or as a key ingredient in a multi-channel journey – successful investment planning requires an understanding of the change in the role of the store, rather than writing it off as a relic of a bygone age.

Retail stores influence purchase in four key ways

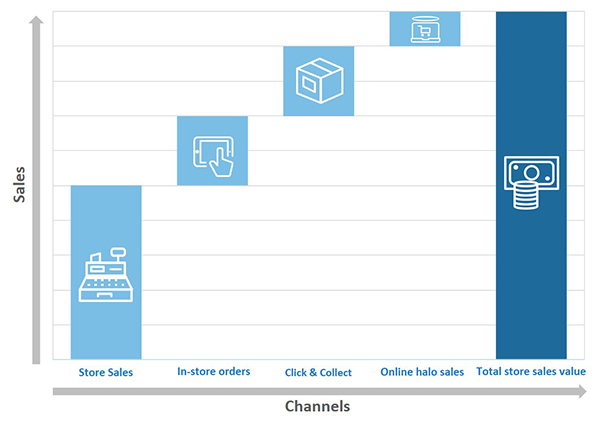

As we move towards retail becoming an ‘integrated marketplace’, with consumers increasingly able to interact with retail brands and transact almost anywhere, using analytics to understand and quantify the role of the store will be key. Whilst the role of AI, wearables and smart tech in facilitating this ‘integrated retail marketplace’ is still being truly defined, there are four well-established performance KPIs on which stores have influence and where analytics-led insight is key to evaluating the true evolving value of the store:

1 Store sales ‘Traditional’ sales generated through visits to the store and completed at the till.

2 In-store orders Products ordered whilst in store for collection of delivery to home (e.g. due to no stock availability in store or extended range options online).

3 Click & Collect Products reserved or paid for online but collected in store.

4 Online ‘halo’ The impact of store presence on online (and call centre) channel performance. As we explored in a previous blog, there is strong evidence from many retailers that store presence helps to drive increased sales and customer engagement through non-physical channels.

Exploring and understanding the role of the retail store in supporting sales in other channels (i.e. the ‘halo’) and cross-channel sales (i.e. click & collect) and the compound benefit this brings to overall business performance is vital in evolving the operating model and determining the future of the store.

In today’s world of eroded consumer loyalty, customers will not just switch to other channels if their store closes but rather, in many cases, they will switch their spending to nearby competitors. Also, without the store to support the transaction, will customers who prefer to click & collect instead choose to switch to other delivery methods from the brand, or will they take their money elsewhere to a business that meets their needs?

Retailers need to assess store value holistically and then optimise the store estate

In evaluating performance and optimising the store estate, it is no longer sufficient to look at the sales and profit delivered by traditional in-store sales in isolation; instead, retailers must build a new holistic P&L assessment to more accurately attribute the benefit that the store brings to the business. For example, a store that is a marginal performer when assessed in isolation (i.e. delivering a financial return close to management’s minimum acceptable level), may be helping to deliver a significant benefit to other channels that may be lost, or at least diminished, if a closure decision is made.

Similarly, analysing the potential of new locations with this omni-channel perspective may also help to reshape the future estate, possibly identifying the need for a greater opportunity/requirement for physical presence than would otherwise appear viable.

The value of retail stores may not just come from direct and indirect sales

Alongside the four KPI pillars, the role of retail stores in supporting a brand’s customer service reputation and setting operational standards should not be overlooked.

A complete assessment of the value of stores to a business should, of course, cover the direct and indirect sales benefit outlined above, but it may also be appropriate to introduce other metrics (e.g. NPS, Accenture’s own LOVE Index, and mystery shopper scores) to truly assess the role of the store today and into the future.

With the retail sector in the midst of rapid evolution, the need for a clear and comprehensive property strategy has never been greater.

For further reading on this topic DOWNLOAD White Paper: DESTINYSCORE – The health of the UK’s highstreets.

FIND OUT MORE about Javelin Group’s Retailer Location Planning service line.